Money Matters introduces students to money management through interactive activities and games. Students will learn budgeting, saving, and spending while exploring concepts like needs vs. wants. This course builds financial literacy in a fun, engaging way, empowering kids for the future.

Grade

3-5

Ages

6-11

Student to teacher ratio

20:1

Min. 8 and Max. 20 students

Session duration

45-90 mins

Adjusted based on school requirements

Frequency

1-2 times per week

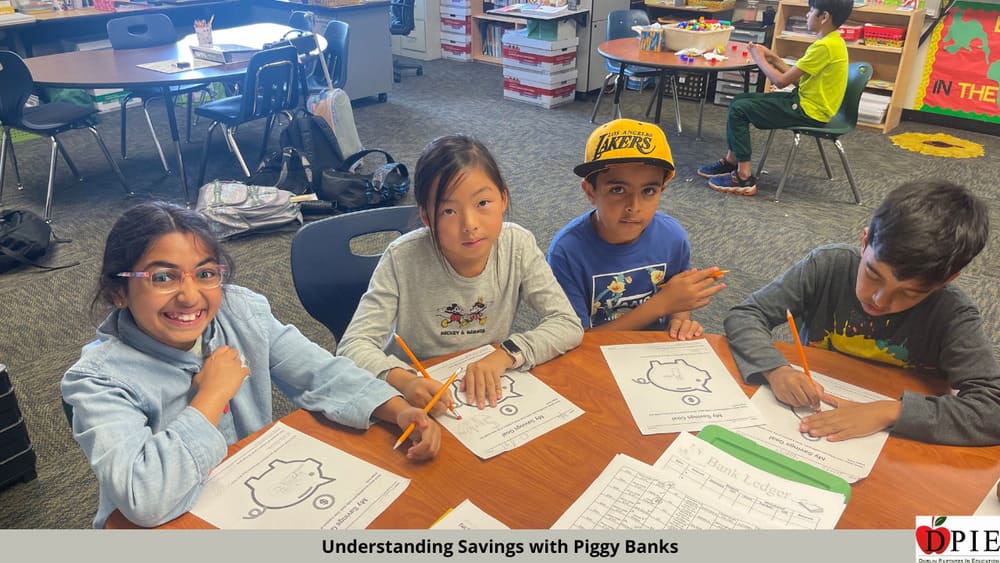

Money Matters – Fun Finance for Kids is a vibrant course that introduces students to the world of financial literacy. Through interactive games, role-playing activities, and hands-on projects, students will explore concepts like earning, investing, managing money, and spending via role-playing and online games. They’ll experience running a mock business, create their own piggy banks, and participate in online challenges to reinforce their learning. The course emphasizes understanding financial goals, making smart choices, and appreciating the value of money. By the end, students will be equipped with the skills to navigate their financial futures with confidence and creativity.

What happens in the class

In these classes, students will engage in interactive and enjoyable lessons focused on essential money management skills. Each week introduces new themes, such as recognizing U.S. coins, understanding U.S. paper money, and learning about piggy bank savings. Students will practice giving correct change and adding and subtracting coins through hands-on activities. Our dedicated teachers create a dynamic and fun environment, helping students develop a solid foundation in managing money. By the end of the course, students will gain practical skills and a better understanding of money management tailored to their age and developmental level, fostering confidence in their financial abilities.

Student outcomes

Comprehend the significance of saving and establishing financial goals.

Develop budgeting skills through practical exercises and role-playing scenarios.

Distinguish between needs and wants to make informed financial decisions.